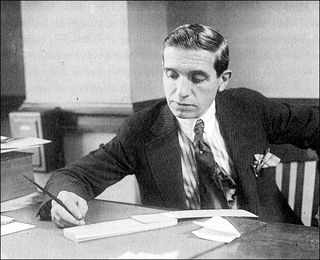

Do the kings of credit default swaps make the suave Charles Ponzi look like a piker?

Blawgletter got a call not long ago from a former official of an institution that oversees pension and retirement fund investments. The impetus? The ex-official's conviction that the $58 trillion market for credit default swaps bears material, if not primary, responsibility for the late wipeout on Wall Street and the deepening worldwide recession.

We've written previously about CDSs, urging Congress to declare the instruments illegal, much as it did during the Great Depression, when it invalidated "gold clauses" that required debtors to pay in gold or gold-equivalent dollars.

Now we wonder about the need for an edict. Do CDSs violate existing public policy? Perhaps they do.

The nature of CDSs. A court recently described a "typical CDS transaction" thus:

[O]ne party (the “protection buyer”) pays periodic fixed amounts to the other party (the “protection seller”) with respect to a specified amount of a “reference obligation” issued by a “reference entity,” here, the Millstone III CDO. In return, the protection seller is required to provide the protection buyer certain consideration if specified events occur with respect to the reference obligation or entity-usually, a negative event concerning the creditworthiness of the reference obligation or entity. The buyer of CDS protection need not actually own the reference obligation or have any relationship to the reference entity.

Citigroup Global Markets Inc. v. VCG Special Opportunities Master Fund, 2008 WL 4891229, at *1 (S.D.N.Y. Nov. 12, 2008) (references to complaint omitted).

The last sentence tells us that anybody can buy "protection". Protection the purchaser doesn't need. Protection that enables the buyer to profit from a "negative event" despite his lack of an economic interest in the reference security.

We'll say more below about the implications, but for now, as the folks at Investopedia gently note, "it is obvious that speculation has grown to be the most common function for a CDS contract."

How it began. The CDS industry got a gigantic congressional shove with the bracingly deregulatory Commodity Futures Modernization Act of 2000. The statute, which Congress rushed through in the final 45 days of the Clinton administration, aimed, it said, "to promote innovation for futures and derivatives and to reduce systemic risk by enhancing legal certainty in the markets for certain futures and derivatives transactions". H.R. 5660 § 2(6).

But it did so, with respect to CDSs, by insulating them from regulation by the Securities and Exchange Commission. The Act achieved that result by amending the Securities Act of 1933 and the Securities Exchange Act of 1934 to bar the SEC from using its principal regulatory tools — requiring registration of securities and reporting of securities transactions.

[Sections 2A and 3A of the CFMA both provide:

(2) The Commission is prohibited from registering, or requiring, recommending, or suggesting, the registration under this title of any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act). If the Commission becomes aware that a registrant has filed a registration statement with respect to such a swap agreement, the Commission shall promptly so notify the registrant. Any such registration statement with respect to such a swap agreement shall be void and of no force or effect.

(3) The Commission is prohibited from–

(A) promulgating, interpreting, or enforcing rules; or

(B) issuing orders of general applicability;

under this title in a manner that imposes or specifies reporting or recordkeeping requirements, procedures, or standards as prophylactic measures against fraud, manipulation, or insider trading with respect to any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act).

Note especially the prohibition on "prophylactic measures against fraud, manipulation, or insider trading with respect to any security-based swap agreement".]

As SEC Chairman Christopher Cox said in September 2008:

The $58 trillion notional market in credit default swaps — double the amount outstanding in 2006 — is regulated by no one. Neither the SEC nor any regulator has authority over the CDS market, even to require minimal disclosure to the market.

Legalizing gambling — and bucket shops. Our immediate thought, when we first smelled the strong whiff of a CDS casino, ran to laws against gaming. We said:

All that sounds to us like pure gambling.

Others felt the same way. As Professor Thomas Lee Hazen observed in 2005:

The illegality of, and law's disdain for, gambling has moral overtones which makes it difficult to draw the line between bona fide market transactions and a wager. Even outside of derivative investments, the law has had difficulty drawing the line between permissible contracts and illegal gambling arrangements. The basic premise is that wagers are illegal and therefore unenforceable as a matter of contract law. Some courts have gone so far as to invalidate a loan on the grounds that the loan was designed to pay for illegal gambling debts.

Thomas Lee Hazen, Disparate Regulatory Schemes for Parallel Activities: Securities Regulation, Derivatives Regulation, Gamgling, and Insurance, 24 Ann. Rev. Banking & Fin. L. 375, 403-04 (2005) (footnotes omitted).

We learned to our chagrin that the same notion had already occurred to sponsors of the CFMA. They, at the very end of the statute, tacked on two get out of jail free cards, which state:

(b) COVERED SWAP AGREEMENTS- No covered swap agreement shall be void, voidable, or unenforceable, and no party to a covered swap agreement shall be entitled to rescind, or recover any payment made with respect to, a covered swap agreement under any provision of Federal or State law, based solely on the failure of the covered swap agreement to comply with the terms or conditions of an exemption or exclusion from any provision of the Commodity Exchange Act or any regulation of the Commodity Futures Trading Commission.

(c) PREEMPTION- This title shall supersede and preempt the application of any State or local law that prohibits or regulates gaming or the operation of bucket shops (other than antifraud provisions of general applicability) in the case of–

(1) a hybrid instrument that is predominantly a banking product; or

(2) a covered swap agreement.

H.R. 5660 § 408(b)-(c).

These subsections, together with the Act's prohibition against SEC regulation of CDSs, mean that the CMFA immunizes CDS transactions from virtually any "prophylactic" measures. Federal laws governing contracts for purchase or sale of commodities don't apply — and, astonishingly, neither do laws that prohibit, or even restrict, gambling and bucket shops (brokerages that take orders for trades but only pretend to execute them)!

What does that leave? The express provisions of the CMFA mandate a broad hands-off approach to federal concerns about CDSs. But, on the positive side, a good bit of non-prophylactic law remains.

Federal securities laws. As the Second Circuit has noted, "Sections 302 and 303 of the CMFA define 'swap agreements' and then expressly exclude them from the definition of 'securities,' but amend section 10(b) to reach swap agreements." Ciaolo v. Citibank, N.A., New York, 295 F.3d 312, 327 (2d Cir. 2002). The court observed that, in light of the amendment to section 10(b) of the Securities Exchange Act, if plaintiff Ciaolo had "entered into his synthetic stock transactions after the enactment of the CFMA, they clearly would now be covered under Rule 10b-5." Id. (holding that Ciaolo waived argument for retroactive application of CFMA by failing to raise it in district court but reversing dismissal of securities fraud claims relating to other "securities" transactions).

Oddly, "antifraud provisions of general applicability" survive the CMFA. As the principal cheerleader for CDS contracts, the International Swaps and Derivatives Association, Inc., observed in a "Memorandum for ISDA Members" on January 5, 2001, even after the CMFA "[s]wap agreements that are based on securities prices, yields or volatilities are, however, subject to specific antifraud, antimanipulation and anti-insider trading provisions of the 1933 Act and 1934 Act."

[The Memorandum apparently refers to provisions in sections 2A and 3A the CMFA. Section 2A states, in relevant part:

(b) ANTI-FRAUD AND ANTI-MANIPULATION ENFORCEMENT AUTHORITY- Section 17(a) of the Securities Act of 1933 (15 U.S.C. 77q(a)) is amended to read as follows:

(a) It shall be unlawful for any person in the offer or sale of any securities or any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) by the use of any means or instruments of transportation or communication in interstate commerce or by use of the mails, directly or indirectly–

(1) to employ any device, scheme, or artifice to defraud, or

(2) to obtain money or property by means of any untrue statement of a material fact or any omission to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading; or

(3) to engage in any transaction, practice, or course of business which operates or would operate as a fraud or deceit upon the purchaser.

H.R. 5660 § 2A(b). Section 3A provides:

(b) ANTI-FRAUD, ANTI-MANIPULATION ENFORCEMENT AUTHORITY- Paragraphs (2) through (5) of section 9(a) of the Securities Exchange Act of 1934 (15 U.S.C. 78i(a)(2)-(5)) are amended to read as follows:

(2) To effect, alone or with one or more other persons, a series of transactions in any security registered on a national securities exchange or in connection with any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security creating actual or apparent active trading in such security, or raising or depressing the price of such security, for the purpose of inducing the purchase or sale of such security by others.

(3) If a dealer or broker, or other person selling or offering for sale or purchasing or offering to purchase the security or a security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security, to induce the purchase or sale of any security registered on a national securities exchange or any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security by the circulation or dissemination in the ordinary course of business of information to the effect that the price of any such security will or is likely to rise or fall because of market operations of any one or more persons conducted for the purpose of raising or depressing the price of such security.

(4) If a dealer or broker, or the person selling or offering for sale or purchasing or offering to purchase the security or a security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security, to make, regarding any security registered on a national securities exchange or any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security, for the purpose of inducing the purchase or sale of such security or such security-based swap agreement, any statement which was at the time and in the light of the circumstances under which it was made, false or misleading with respect to any material fact, and which he knew or had reasonable ground to believe was so false or misleading.

(5) For a consideration, received directly or indirectly from a dealer or broker, or other person selling or offering for sale or purchasing or offering to purchase the security or a security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security, to induce the purchase of any security registered on a national securities exchange or any security-based swap agreement (as defined in section 206B of the Gramm-Leach-Bliley Act) with respect to such security by the circulation or dissemination of information to the effect that the price of any such security will or is likely to rise or fall because of the market operations of any one or more persons conducted for the purpose of raising or depressing the price of such security.

H.R. 5660 § 3A(b). These three sets of provisions, as we read them, have the effect of applying to CDS transactions the causes of action and remedies available (1) for securities fraud under <span section 10(b) and SEC Rule 10b-5 and (2) for manipulation of securities prices under section 9 of the Securities Exchange Act.]

<span Racketeer Influenced and Corrupt Organizations Act. RICO authorizes recovery of treble damages plus attorneys' fees for certain kinds of fraudulent conduct. And just last year the U.S. Supreme Court clarified that RICO doesn't require direct reliance by the victim in cases involving mail or wire fraud as the predicate acts. See Bridge v Phoenix Bond & Indemnity Co., 128 S. Ct. 2131 (2008).

<span But in 1995 Congress amended RICO to bar claims, with few exceptions, that rely on "conduct that would have been actionable as fraud in the purchase or sale of securities". 18 U.S.C. § 1964(c). We doubt that narrowing of RICO reaches fraud involving CDSs, which the CFMA defines as "security-based swap agreement" separately from "security".

Contract law. The sparse case law applies contract law doctrines as if the CMFA didn't exist. For example:

- Commercial impracticability. In Hoosier Energy Rural Electric Co-op, Inc. v. John Hancock Life Ins. Co., 2008 WL 5068649 (S.D. Ind. Nov. 25, 2008), the court granted Hoosier Energy a temporary injunction against enforcement of CDS contracts. The court applied New York law in determining that the doctrine of "temporary commercial impracticability" excused Hoosier Energy from its obligation to replace the CDS of a swooning seller of credit default protection with a more solid one. The court later required Hoosier Energy to post a $121 million bond as a condition to continuing the preliminary injunction against enforcement. Hoosier Energy Rural Electric Co-op, Inc. v. John Hancock Life Ins. Co., 2008 WL 5216027 (S.D. Ind. Dec. 11, 2008). News article here.

- Unilateral mistake. The court rejected a claim for rescission under the New York doctrine of unilateral mistake because the plaintiff, "a sophisticated hedge fund, simply failed to review carefully the terms of the parties' agreement." VCG Special Opportunities Master Fund Ltd. v. Citibank, N.A., 2008 WL 4809078, at *7 (S.D.N.Y. Nov. 5, 2008).

- Late delivery. Deutsche Bank waited too long to fulfill a condition to payment on a CDS contract — delivery of the bonds as to which it bought protection. Deutsche Bank AG v. AMBAC Credit Products, Inc., 2008 WL 1867497 (S.D.N.Y. July 6, 2006).

- Wrong "reference entity". The court concluded that "Republic of Phillipines" as the "Reference Entity" under a CDS contract didn't encompass the General Service Insurance System, an agency of the Phillipines government. Aon Fin. Products, Inc. v. Societe Generale, 476 F.3d 90 (2d Cir. 2007) (applying New York law).

Presumably other doctrines of contract law, including unconscionability, apply as well.

Creating intolerable systemic risk — inherent fraud? A buyer of CDS protection may run afoul of federal securities laws, for example, by exploiting non-public (inside) information about the issuer of a reference security, by making manipulative trades or spreading rumors that trigger a default, and in myriad other ways. But securities laws and contract doctrines generally aim to adjust individual disputes over specific transactions.

Does an across-the-board remedy for sellers of CDS protection to protection-buying gamblers exist? Under what theory? How about this: inherent fraud arising from pushing "systemic risk" – the hazard to the financial system itself — to the point of collapse.

Economist Arnold Kling wrote last October:

The problem with credit default swaps is not (just) that they are traded over-the-counter. The more serious problem is that they entail huge systemic risk. Getting rid of counterparty risk does not solve the problem. The issue is not that any one party is unable to meet its obligations. The issue is that in the aggregate, credit default swaps allow the market to sell more default risk protection than it's possible to produce. This false sense of security leads people to pile on risk, and then when the crisis comes, their protection fails.

Let us pause here to recall that the CFMA claimed as one of its purposes the reduction of "systemic risk by enhancing legal certainty in the markets for certain futures and derivatives transactions". H.R. 5660 § 2(6).

The failure of Lehman Brothers — and the near-burial of AIG — illustrate how the meteoric growth of the CDS market created an unacceptable degree of systemic risk. CDSs that used Lehman or AIG bonds as the reference securities triggered an obligation to pay losses to the protection buyers. The sellers then had to scramble to meet demands for payment. The ensuing payments and liquidation of marketable assets – almost always other issuers' bonds and securities – depressed the market value of not only the protection sellers themselves but also of the other issuers whose securities glutted the market.

The process cascaded through the market. Financial institutions — including such titans as Citigroup, Bank of America, Wachovia, Goldman Sachs, and Morgan Stanley — teetered on the brink. Only the blank-check Wall Street bailout allowed them to survive.

And where did the bailout money go? Thanks to the opaqueness of the CDS market and of the Treasury Department's secretive and stumbling implementation of the bailout, even the Congressional Oversight Panel observed on January 9, 2009, that it "still does not know what the banks are doing with taxpayer money."

On October 26, 2008, 60 Minutes aired a segment it called "The Bet That Blew Up Wall Street: Steve Kroft on Credit Default Swaps and Their Central Role in the Unfolding Economic Crisis". The report includes this:

But the rocket fuel was the trillions of dollars in side bets on those mortgage securities, called "credit default swaps." They were essentially private insurance contracts that paid off if the investment went bad, but you didn't have to actually own the investment to collect on the insurance.

"If I thought certain mortgage securities were gonna fail, I could go out and buy insurance on them without actually owning them?" Kroft asks Eric Dinallo, the insurance superintendent for the state of New York.

"Yeah," Dinallo says. "The irony is, though, you're not really buying insurance at that point. You're just placing the bet."

Dinallo says credit default swaps were totally unregulated and that the big banks and investment houses that sold them didn't have to set aside any money to cover their potential losses and pay off their bets.

"As the market began to seize up and as the market for the underlying obligations began to perform poorly, everybody wanted to get paid, had a right to get paid on those credit default swaps. And there was no 'there' there. There was no money behind the commitments. And people came up short. And so that's to a large extent what happened to Bear Stearns, Lehman Brothers, and the holding company of AIG," he explains.

At some point, the systemic risk from CDSs tipped from merely frightening to catastrophic. Those players who continued to hoe and frolic in the market after that point — when the sub-prime mortgage crisis reared its ugly head? – poured on gasoline after the tool shed had already caught fire.

Did they engage in inherently fraudulent transactions? Unconscionable ones? We suppose the courts will start grappling with those and similar questions.